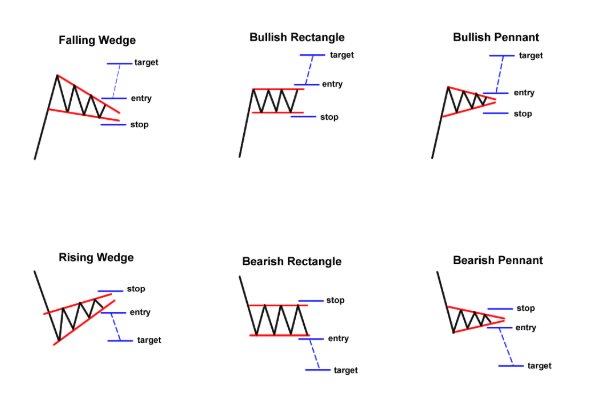

31/10/ · Traders look for a subsequent breakout, in the direction of the preceding trend, as a cue to enter a trade. 2. Bullish Pennant. A bullish Pennant pattern is a continuation chart pattern that Estimated Reading Time: 6 mins These formations are trend continuation patterns which are often used by traders for making decisions. Trend continuation patterns are formed during the pause in the current market trends, and mark rather the movement continuation than its reversal. By contrast with the model of trend reversal, the figures are often formed at shorter time intervals Trend Continuation Patterns. Technical analysis provides charts that reinforce the current trends. These chart formations are known as continuation patterns. They consist of fairly short consolidation periods. The breakouts occur in the same direction as the original trend. The most important continuation patterns are: Flags; Pennants; Triangles; Wedges

7 Forex Trend Continuation Chart Patterns - blogger.com

What do we know about price? It is either moving up or down or sideways. Charts have a fancy way of capturing the motion signaling a continuation or reversal. Price rises to establish a new high, it retraces then bounces up again, at the level of the first high it will drop, but it will print a higher low, this will continue until it breaks out. If you draw trendlines best trend continuation pattern forex the tops and another tracing the best trend continuation pattern forex, you will see a triangle pattern.

Quite often, price shoots up without notice. When it does, a bullish pennant is what to look for to determine if it will continue upwards.

Price shoots up to levels higher than the candles on the left, briefly consolidates printing higher lows and low highs, forming a triangle when connected with trendlines.

When you draw a trendline connecting the lows and another connecting the highs, you will see what looks like a flag. The bullish rectangle pattern forms when an uptrend stalls creating new support and resistance levels. The price will go sideways, printing highs at the resistance levels and lows at the support level. Draw a trendline joining the highs and another joining the lows to see how the highs and lows are almost parallel.

Place the stop loss anywhere below the support level for the buys and above the resistance level for sell orders. When the market is in a downtrend, look through these bearish continuation patterns for possible entries. The descending triangle pattern is a bearish continuation chart pattern that forms in a downtrend. The descending triangle is visible when the upper trendline that joins the highs intersects with the trendline that joins the lows.

Price momentarily consolidates, printing lower lows and lower highs before breaking out to the downside. The bearish rectangle chart pattern is a graphical representation of the sideways movement of price during a downtrend. Price takes a break forming a support and resistance level from where price ping pongs before the bears resume the downtrend. Like the bullish rectangle, breakout, positional, and range, best trend continuation pattern forex, traders can find the bearish rectangle chart pattern useful.

Place the stop loss anywhere below the support level for the buys and above the resistance level for the sells. Continuation chart patterns are good indicators naked chart traders use to get in and get out of trades. Go to Source of this post Author Of this post: Joshua Okapes Title Of post: 7 Forex Trend Continuation Chart Patterns Author Link: {authorlink}.

Skip to content Home Top Forex News 7 Forex Trend Continuation Chart Patterns. With only trendlines, naked chart traders jump into the best trend continuation pattern forex when price breaks out.

Previous: Forex Brokers with the Lowest Spreads on EURUSD. Next: Weekly Fundamental US Dollar Forecast: Taper Talk to Intensify at September Fed Meeting, best trend continuation pattern forex.

Related Stories. Shorting the USDCAD in advance of the Best trend continuation pattern forex Statement 1 min read. Top Forex News. Shorting the USDCAD in advance of the FOMC Statement. September 23, FOMC Statement, Forecasts, and Press Conference 1 min read, best trend continuation pattern forex.

FOMC Statement, Forecasts, and Press Conference. FOMC Preview 1 min read. FOMC Preview. You may have missed. Flexible working from day one — what it means for SMEs 4 min read. Top Small to Medium-Sized Business News. Flexible working from day one — what it means for SMEs. The essential guide to small business marketing 22 min read.

The essential guide to small business marketing, best trend continuation pattern forex. A Million Small Businesses Have Applied for PPP Loan Forgiveness with SBA Portal 2 min read. A Million Small Businesses Have Applied for PPP Loan Forgiveness with SBA Portal.

�� The Only CHART PATTERNS Technical Analysis \u0026 Trading Strategy You Will Ever Need - (FULL COURSE)

, time: 15:00The Only Trend Continuation Patterns We Need To Know -

18/09/ · Continuation chart patterns are at the heart of trading trends; they capture a price consolidation on its way to the trend’s direction. With only trendlines, naked chart traders jump into the trend when price breaks out. We’ll consider 7 of the best trend continuation chart 02/03/ · The descending triangle pattern is a bearish continuation chart pattern that forms in a downtrend. The descending triangle is visible when the upper trendline that joins the highs intersects with the trendline that joins the lows. The trend continuation is confirmed once the price breaks out below the lower trendline Trend Continuation Patterns. Technical analysis provides charts that reinforce the current trends. These chart formations are known as continuation patterns. They consist of fairly short consolidation periods. The breakouts occur in the same direction as the original trend. The most important continuation patterns are: Flags; Pennants; Triangles; Wedges

No comments:

Post a Comment