Forex margin rates are usually expressed as a percentage, with forex margin requirements typically starting at around % in the UK for major foreign exchange currency pairs. Your FX broker’s margin requirement shows you the amount of leverage that you can use when trading forex with that broker 29/12/ · Free margin is that specific amount of money in a trading account which is available for using to open trading in new positions. Calculation system of free margin is quite easy as it can be calculated by following this theory: (Account Equity – Used Margin) A question should be arising on your mind which is “what is the equity in forex?”Estimated Reading Time: 10 mins 23/02/ · Free Margin is the difference between Equity and Used Margin. Free Margin refers to the Equity in a trader’s account that is NOT tied up in margin for current open positions. Free Margin is also known as “ Usable Margin ” because it’s margin that you can “use”.it’s “usable”. Free Margin can be thought of as two things

Leverage, Margin, Balance, Equity, Free Margin, Margin Call And Stop Out Level In Forex Trading

TOP FOREX BROKERS REVIEW. But if you are a starter that " what is equity in forex " and " margin level forex ", then it is surely a completely new concept for you.

So, whether you are an expert or a newcomer, either way you have to master on this term if you want to make money and become successful in forex trading. Therefore, we come up with this article to make you understand all the ins and outs of what is free margin in forex market.

Margin is basically the security or collateral which a trader needs to deposit in their broker house so that it can cover a portion of the capital risk which the trader makes by trading for the broker. It is actually the gaps or portion of an what is margin free in forex trading that is expressed in writing as a percentage number.

It is better for you if you think a margin as the deposit of your all trades. It is the margin which decides the maximum amount of leverage you will be able to use in your account. Margin is usually required by the best forex broker for your trading account. But trading on margin has different sorts of consequences as well. For more information you can also read forex education one of the best forex broker reviews sites. It can certainly influence the trading results or outcome which can be positive or negative and there will be a chance of potential profits and losses as they will be seriously magnified.

Suppose, a broker is offering a leverage of for trading in forex. This offered leverage means that for each 25 units of currency in any open position, only 1 unit of currency will be required as the margin.

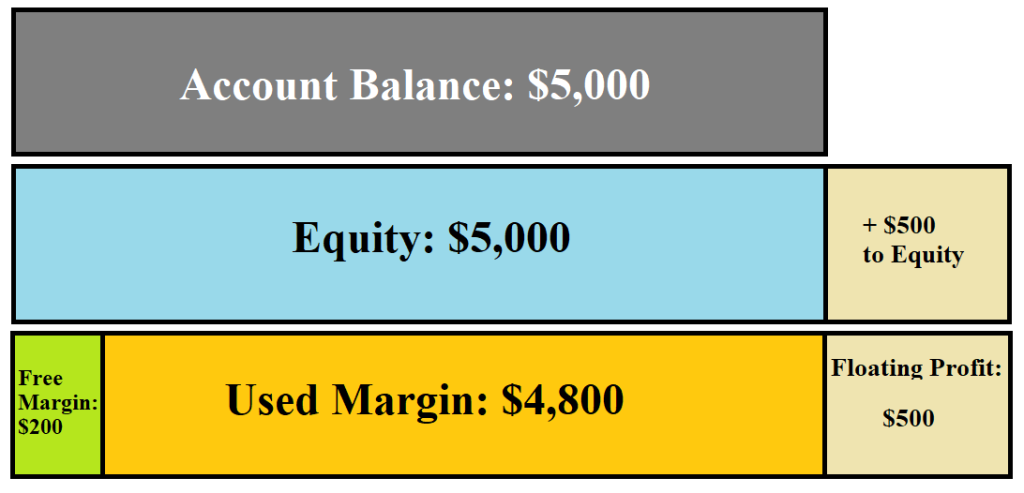

Forex education is the right platfrom to know about this. Free margin is that specific amount of money in a trading account which is available for using to open trading in new positions. Calculation system of free margin is quite easy as it can be calculated by following this theory: Account Equity — Used Margin. Now, the application of the above-mentioned theory of calculating free margin mainly deals with the unrealized loss or profits from the open positions in equity forex trading, what is margin free in forex.

Therefore, if you are currently holding any open position with profits, then you are free to use this profit to open new positions on your account as an additional margin. We can have a better understanding on what is free margin in forex with an example.

So, when you will open the trade, what is margin free in forex, these will be the outcome:. You should also know that, if the value of the position had decreased by the same amount, then the amount of equity and free margin will also be decreased in the same manner. As we have previously mentioned about equity, here we are giving you a complete insight of what is equity in forex?

Equity is the total amount of the trading account balance with the amount of unrealized profit or loss from any open position.

When the discussion of the account balance will be on the table, we have to talk what is margin free in forex the total deposited money of the what is margin free in forex account.

This sum will also include the used margin for an open position. If there is no trades open for you in the trading market, what is margin free in forex, then the equity will be equivalent to the balance of trading account. If you want to make some profits in forex trading, then you should be well-acknowledged of what does equity mean in forex. Margin level forex is a very important concept of understanding trading.

It illustrates the ratio of equity and used margin in a trading. Forex brokers have to use margin level forex to determine whether a forex trader can take any new position in the market or not. But the scenario can change, if you add some extra cash to your what is margin free in forex account or the unrealized profits of your account increase somehow. Hope you get the complete picture of what is free margin level in forex from this discussion. For more information, you can also visit forex broker reviews where you get all current updates about the margin level.

But if the market turns around and your equity amount increases again, or you put some more cash money into your trading account, then you will be able to open a new position on your account.

This is the way of how to calculate margin level percentage in forex. As a forex trader, you need to understand a pretty important concept of forex trading which is the difference between margin and leverage in forex. Leverage and forex margin are correlated to each other in many aspects of forex trading even though they have different meanings.

We have already provided you the full insight of forex margin and make you understand what a forex margin is. It is the deposit money which is required to place any trade in the forex market to keep a position open.

Whereas, leverage, on the contrary, means enabling the traders to trade for larger position by outlaying a smaller capital. A leverage ratio of means that the trader has the ability to control a trade worth 25 times their starting investment.

In forex trading market, leverage is basically related to margin value which indicates the trader what amount of forex margin level percentage of the total trade sum is required to open that certain trade. This is the whole formula of the relation between the margin and the leverage. In the forex market, pips percentage in points is used for determining the currency movements.

A pip is the smallest movement which a currency can make in the forex market. And it is basically just a one cent move as per the forex exchange value. But when you will use the leverage in trading, this one cent move will earn you a lot of profits. This is why leverage is considered one of the important tools of forex trading. Because it gives the opportunity to the small price movements so that they can be transformed into a larger profits.

However, it has the same opposite reaction as well. It can bring you larger losses at the same time if things go different ways in the market. Therefore, it is very important that the leverage is properly managed like the experts. Leverage in forex trading is a feature which is used for derivative trading, for example as forex spread betting and contracts which is used for different trading. Leverage can also play a vital role in taking positions across a wide range of asset classes other than the forex currencies.

It includes indices, commodities, and stocks as well. These are all about the difference between margin and leverage in forex. If you are dealing with leveraged forex trading, margin is the most important concept you need to understand on the first place.

Margin is the amount of money which a trader requires to take forward to place a trade in the market and maintain the open position there.

Though people think margin is a transaction cost, but it is not. It is rather a security deposit which the broker holds during an open trade to cover the potential loss of the broker. Traders usually increase their exposure by trading currencies on margin. Margin also allows the traders to open trading positions which are leveraged. It can manage the larger trades with a smaller amount of capital in the market, what is margin free in forex.

Margin level means that specific amount of money which a trader left available on his account to open further positions in the market. Trading on margin in forex is a popular strategy which is currently used by millions of traders all over the world. Here are the top 10 forex brokers in the world. This is because of using the leverage which is subsequently used for taking larger positions to make profits.

However, the losses will be magnified the same way as the profits by trading on margin. You should be well-aware of the fact as well. It would be better for the traders, if they spend some time to understand how the margin works in the forex trading. It should be done before doing any trading using the leverage in different forex market. It is very important to understand all the concepts such as marginwhat is margin free in forex, free marginmargin level, margin calls, etc. Margin and free margin in forex are two of the hot topics on which debates are going all over the forex market every now and then.

Traders and brokers has different opinions and theories on margins. Some traders say that too much margin is not good for the traders. In fact, they argue that, it is quite dangerous and it is easy to what is margin free in forex why they are arguing on this. However, individual trading style as well as experience in trading play an important role in trading with too much margin.

Trading on margin is a profitable forex strategy for both the new and veteran forex traders. But you should also know that you need to be well-aware of the associated risks of trading on margin. In order to utilizing forex margin, what is margin free in forex, you must ensure the complete understanding of your whole account operation process.

Make sure that you go through the whole agreement paper with proper understanding before signing it. Never sign the paper without the proper knowledge about the whole of it. Top Rated Online Best Forex Brokers What is margin free in forex my name, email, and website in this browser for the next time I comment. Best Forex Brokers. FX Brokers by Category. Forex Brokers What is margin free in forex. Forex Education.

Trading Resources. FX Regulations. Forex Broker Comparison. FX BROKERS BY COUNTRY. FX Account Types. FX Trading Platforms. Forex Bonus.

Forex Signals. Scam Brokers List. What is Margin in Forex?

Explaining Balance, Equity, Margin, Free margin and margin level on MT4/MT5 mobile platform.

, time: 6:46What is Free Margin in Forex – ☑️The Ultimate Guide ()

Free margin level in forex trading. The amount of money you have in your trading account is your account balance. If you don’t have any open positions or trades, that means your equity is the same as your trading balance 27/09/ · That amount of money is the margin. Free Margin is the amount of money that is not involved in any trade. You can use it to open more positions. Let’s look at margin and free margin in forex in details; What is a margin in forex trading. A margin is good faith deposit collateral your broker locks to allow you to hold blogger.comted Reading Time: 4 mins 23/02/ · Free Margin is the difference between Equity and Used Margin. Free Margin refers to the Equity in a trader’s account that is NOT tied up in margin for current open positions. Free Margin is also known as “ Usable Margin ” because it’s margin that you can “use”.it’s “usable”. Free Margin can be thought of as two things

No comments:

Post a Comment