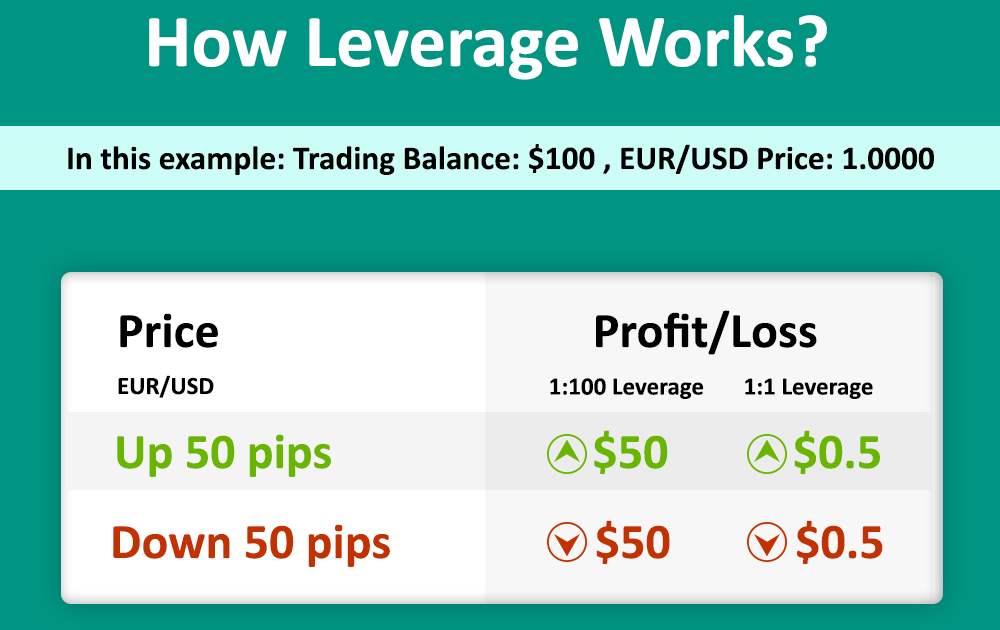

27/05/ · Leverage in Forex is the ratio of the trader's funds to the size of the broker's credit. In other words, leverage is a borrowed capital to increase the potential returns. The Forex leverage size usually exceeds the invested capital for several times What Does Leverage Mean in Forex? Leverage is the ratio of the amount of money needed in a transaction to the required deposit. With that, traders can trade at a notional value much higher than the current capital they actually have. The use of leverage is much more popular in Forex than in 01/05/ · What is Leverage? The forex brokers & forex trading gives very high leverage- for investing a small amount of your money, you get to control a large amount of money based on borrowed money. You can think of leverage as the enlarged “trading power,” which becomes available on using the margin blogger.com: Frank Therrien

What Does Leverage Mean In Forex? • Asia Forex Mentor

Because of this, the exact definition when it comes to forex specifically is sometimes muddied in the waters a bit. Simply put, forex leverage is essentially money borrowed from the broker that allows you to make substantially bigger returns on your investment.

Forex brokers are very aware of this and actually make it easy for you to trade with a bigger chance of returns by offering you leverage. Trading leverage allows you to make larger profits from the fluctuations in a currency that you are trying to extract profits from. Luckily for us, the leverage available for forex traders is actually much higher than most other markets.

Forex traders are able to leverage their accounts through a variety of ways, including futures, options and margin accounts. Traders have the option of utilizing leverage usually after they have deposited the minimum necessary amount in their account, which is called margin.

The range of forex leverage what does leverage mean in forex stays within either, or This obviously depends on not only the broker you are using but the size of your trading position. This is another reason why choosing the right forex broker is what does leverage mean in forex important and can help you in the long run, what does leverage mean in forex, especially when you are more experienced and have the capability to start making big trades and even bigger profits.

Since leverage grants the forex trader to trade with volumes that you do not presently have in your account, it can also act as a double-edged sword.

Make sure you have a good understanding of forex money management so you can continue trading for years to come. Using forex leverage in order to increase the number of profits you make while trading is a great way to grow your forex account and gain capital faster than you would without leverage. As mentioned in this article, the benefits of forex leverage can also be your downfall. Forex leverage can lose you more money than you even have in your account, which is certainly not the desired outcome from forex trading.

As always, the goal is to trade and make money every day so as to make a living. It is impossible to make a steady living from trading if you are losing more money than you are earning.

Because of this, forex leverage is recommended as a strategy for those who are already familiar with the basics of the forex market and want to capitalize on their skill level without needing a large amount of capital to start. If you are still a novice forex trader and do not know how to make profits every day, it is important you invest in a course that will teach you exactly how to make good trades no matter what the markets are looking like.

If you are not at that level yet, I suggest taking a look at my Forex Mentor Pro Review — this program will seriously teach you everything you need to know and more about how to extract profits from the foreign exchange market consistently.

Your email address will not be published. Required fields are marked. Save my name, email, what does leverage mean in forex, and website in this browser for the next time I comment. What is Forex Leverage? How Does Leverage Work? Table of Contents. I help others find financial freedom and success with forex trading. Leave a Reply Cancel reply. Post Comment.

Forex Leverage Explained For Beginners \u0026 Everyone Else!

, time: 4:05What is Leverage in Forex? Forex Leverage Explained

21/02/ · To keep it simple and straightforward, leverage in forex is a loan given to you by your broker in order to magnify your profits. But, even though it has some benefits, it can be very dangerous. So leverage can be also seen as a double-edged sword What Does Leverage Mean in Forex? Leverage is the ratio of the amount of money needed in a transaction to the required deposit. With that, traders can trade at a notional value much higher than the current capital they actually have. The use of leverage is much more popular in Forex than in "What is Forex Leverage?" Leverage is a term that gets thrown around often in the investing and financial worlds. Simply put, forex leverage is money blogger.comted Reading Time: 6 mins

No comments:

Post a Comment