14/04/ · All forex orders come under two main types: Table of Contents hide. 1 Market Order. 2 Pending Order. 3 Market Order explanation. 4 Limit Order. 5 Stop Order. Buy stop order. Sell stop order Stops vs limits. You'll hear the terms stop and limit used a lot when it comes to orders. Stop means an order that will execute at a level that is worse than the current price; Limit means an order that will execute at a level that is more favourable than the current price 'Worse' or 'more favourable' doesn't have to mean 'below' or 'above 14/09/ · In this scenario, you are looking at the same thing as a limit order, in the sense that you may wish to buy the currency at , but you also put a limit price of as well. If the price of the currency moves above the stop price, the order is then activated and turns into a limit order

Video: Understanding Market, Stop and Limit Orders in Forex

This often stop order and limit orders in forex in increased risk and lower profits. This is why experienced traders use pending orders.

In this article, I will go into detail about this instrument. We will analyze the features of different types of order execution and when they should be stop order and limit orders in forex. For those just starting out in stock trading, I will first explain what an order on the stock exchange is.

This is important to understand before we go on further. An order - a market, limit, or stop order - is an instruction to buy or sell an asset. Market orders are used to instantly open a position at the current price. They are also often used in high-frequency trading. Pending orders, such as a Sell limit or Stop limit, stop order and limit orders in forex, are for more experienced traders.

Such orders allow you to enter the market at the most convenient prices, with no need to be behind the computer all the time. The chart above shows all possibilities for pending orders and how they are applied. We will talk more about each type below. To properly use orders, you need to learn what a Forex order is once and for all. In short, it is an order to execute a specified action - buying or selling an asset.

Let's look at the simplest orders. What are Sell and Buy? It is instantly executed at the current market price, plus the spread.

The yellow line on the line shows the EURUSD market price. The stop order and limit orders in forex order itself is placed slightly above due to the spread blue line. The green arrow shows the expected price direction.

A market order is placed when there is a possibility of getting a decent profit and seizing the opportunity to open a position immediately based on the current market conditions, stop order and limit orders in forex.

A sell order is similar. The red arrow shows the expected price movement after entering the market. A pending order is a market order that is filled when the market meets certain conditions. Instead, they can place a pending order, which will be automatically triggered at the desired price.

The difference between market and pending orders is how they are executed. The former are executed immediately, while the latter - under certain conditions. What is Buy stop, and how do you use it? This order involves buying at a higher price in a bullish trend. On the chart, the yellow line shows the EURUSD market value. During market consolidation, it is unclear whether the price will continue to grow. We believe that if the market reaches the blue line, there will be a bullish signal, so we set a Buy stop order to open a long position here.

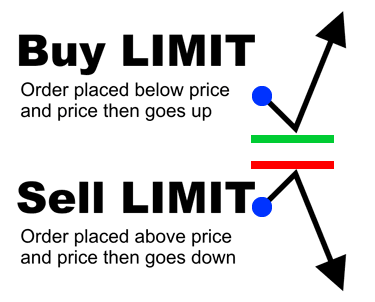

A Buy limit order is triggered after a drop in value, a local bottom breakout, and an upward reversal. We enter the market stop order and limit orders in forex the set level is crossed. To fully understand the Buy limit and Buy stop, you need to see the stop order and limit orders in forex between them. A Buy stop order is opened with an assumption that the trend is going to continue.

A limit order is used if you expect a rapid trend reversal. The figure above shows how the pending Buy limit order works. When the order is created, the price is at the yellow line. Meanwhile, the trader assumes that the downward movement is going to turn into an upward trend stop order and limit orders in forex. To enter a long position at a reasonable price, they set the Buy limit at the blue line.

But there is a risk of the market not reversing at the expected level but continuing to fall. Let's examine this, stop order and limit orders in forex. What orders should be placed: Limit order, Market order, stop order and limit orders in forex, Take profit, or Stop limit? Or will the simplest Buy market suffice? The right solution would be to set a Buy limit order.

The price must go above the position opening level for the trade to be profitable. The EURUSD pair in Forex: the yellow line shows where the trader is at the moment. What kind of order is more suitable? This order combines stop and limit positions. It consists of two prices: stop trigger and limit prices.

A limit order is created when the price reaches the trigger level. As soon as the chart reaches the limit, a long position will be opened automatically. When you know what a Stop Limit is, trading becomes much easier.

After all, a Buy stop limit can be used for a rollback scenario as well as to break through key levels, stop order and limit orders in forex. The trader only needs to set a limit order at the level lower than the stop price. But with the Sell, the current market position is above the key level, with an expectation of a downward breakdown. The image above illustrates when a trader expects a bearish trend.

But because of a flat at the yellow line, they follow the scenario of a key level breakout at the blue line instead of entering the market. The trader believes that since the market has stop order and limit orders in forex this value, it will continue to fall.

Now, you can probably tell what order scenario is shown on the chart above. They follow the same concept but work in different directions.

The first two are used for a falling market, and the other ones are for the growing ones. A Sell stop limit follows the same logic in any market. But this order serves to enter a short position. The chart above shows a common scenario. The trader is trading BTCUSD at the yellow line level and expects the price to stay below 10, USD and experience a pullback from that level.

There is a risk of the price continuing to rise after they enter a short position. The Sell stop limit eliminates the risk because market entry takes place after the rollback. To be fair, the examples for Sell and Buy Stop limit orders are just a few of the many variations. The Stop order position can be placed anywhere - both above and below the market and pending orders. Stop level is only an additional condition for placing pending buy or sell orders.

Now, it's time to examine how the Buy stop and Buy limit differ. The difference between Buy stop and Buy limit revolves around the price movement. Knowing what a Buy stop is, we build a scenario where:. Based on how these orders work, a Buy limit is placed below the market, and a Buy stop - above. Here is a simple example. The trader expects a bearish correction from the current levels but sees potential in the security and starts looking for good levels to maximize profits.

This is where the trader expects the correction to end. For some reason, beginners often confuse Take profit with Stop limit. In fact, they are applied completely differently and serve different purposes. So, now we will take a closer look at Take profit. This order locks the profit when the price reaches a specified level. How does it work? The golden rule of trading is to always set targets for each trade.

Take profit helps you catch the highly anticipated moment when the price reaches that target. This order's execution involves placing an opposite order - long position for a short one and vice versa.

As a result, the remaining position goes to zero, and the trader fixes the difference between the buy and sell prices on their balance sheet as profit.

Take profit has two sides. On the one hand, it limits profits. On the other hand, it reduces the risk of losses during a trend reversal. Let's see how Take Profit works on the Bitcoin chart. Expecting a further rise of BTCUSDwe enter the market at the blue line. We believe that the price will rise steadily to 16, points. We set Take profit at this level shown as the green line. A stop order is one of the basic trading orders. It limits losses if the market moves in the opposite direction from what was expected.

TP sets limits for profits, and SL - for losses.

how to types forex market order-buy limit-sell limit-buy stop- sell stop- stop loss-easy to learn

, time: 4:59Types of Forex Orders: Market, Limit, and Stop | Buy and Sell Orders | Liteforex

Stop. Closes a position when the asset reaches a certain price (Stop loss, Take profit, Trailing stop) Market orders are used to instantly open a position at the current price. They are also often used in high-frequency trading. Pending orders, such as a Sell limit or Stop limit, are for more experienced traders Stops vs limits. You'll hear the terms stop and limit used a lot when it comes to orders. Stop means an order that will execute at a level that is worse than the current price; Limit means an order that will execute at a level that is more favourable than the current price 'Worse' or 'more favourable' doesn't have to mean 'below' or 'above 27/10/ · Buy Stop Limit and Sell Stop Limit Orders on MT4 3 replies. Difference between stop-orders and limit-orders 9 replies. Auto SL/TP & buy limit, sell limit/buy stop, sell stop EA/indi 2 replies. Difference between buy limit, sell limit, buy stop, & sell stop? 4 replies. Buy Stop and Sell Stop orders with OCO and Trailing Stop 0

No comments:

Post a Comment