03/10/ · A gap is a blank space that occurs on a chart after a price has moved sharply up or down. If major news is released after the exchange has already closed, you’ll probably see a price gap on a chart the next day 25/01/ · The price gap is the empty area, hence the name, that occurs when the opening price of a candlestick is not the same as the close price of the previous candlestick. Despite not that common as in stock trading, gaps do happen in the forex market too, mainly because of the fact that the forex market is closed for retail traders during the weekend but it is still active for operations by the International Bank 05/01/ · Gaps can be a powerful asset to the price action trader. They provide added confluence to an already-established level in the market, which can help to put the odds in your favor. Just remember these important points when using Forex gaps to your advantage:Estimated Reading Time: 7 mins

How to Trade Gaps on the Forex Market - Practical Video

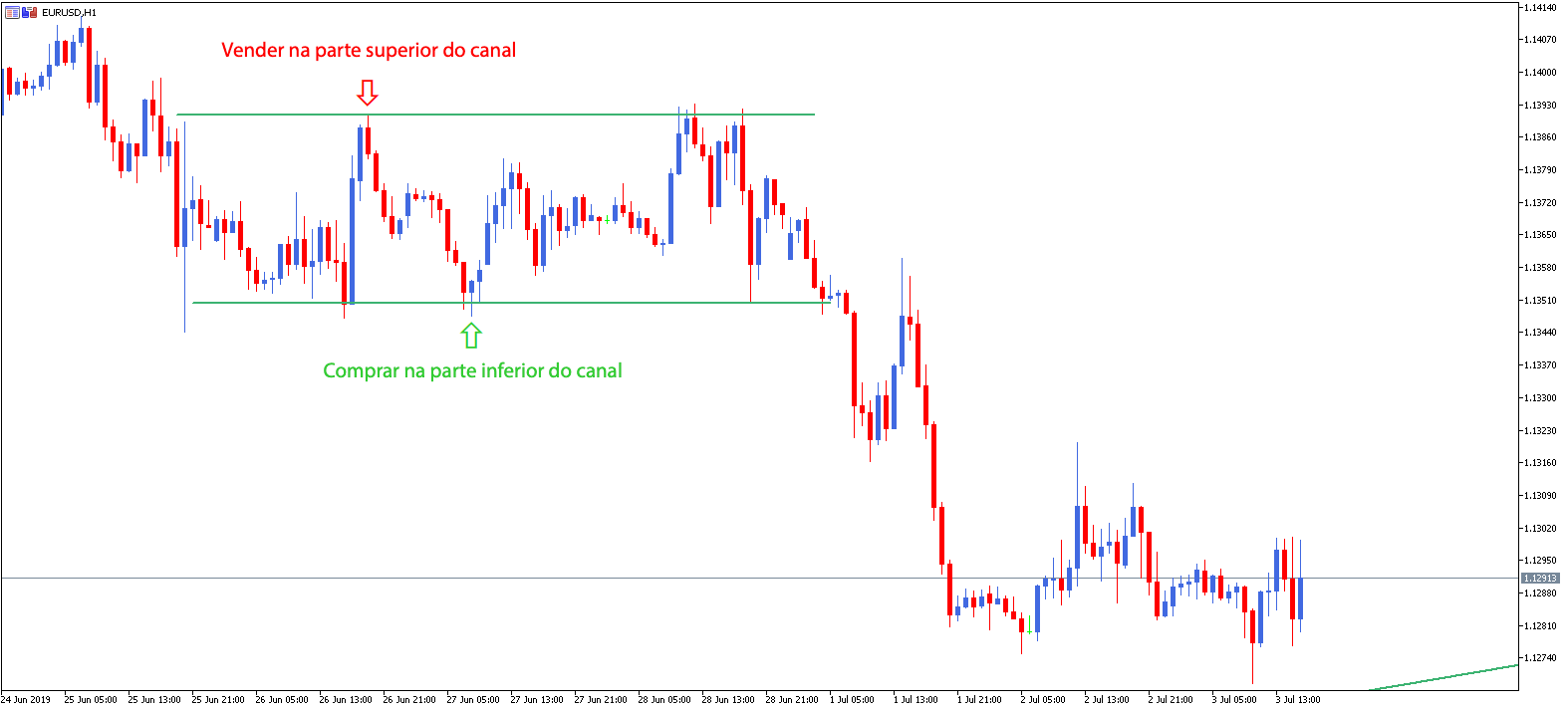

The forex gap trading strategy is an interesting price action trading system that is based on a phenomenon known as the forex gap. A forex gap happens when the opening gap price action forex of candlestick is not the same as the close of the previous candlestick.

Gap price action forex the forex market, gaps are not as frequent as in the share market. The gaps in forex tend to happen when the market closes on Saturday and Opens On Monday. There is a reason why trading of gaps occur. The main idea or concept of gap trading is that p rice will always try to fill the gap. Well, for one, it is said that because there is no support or resistance in the gap, price has freedom and room to move inside the gap. The forex gap itself takes its origin in the fact that the interbank currency market continues to react on the fundamental news during the weekendopening on Monday at the level with the most liquidity.

Generally it is assumed that for gap trading to happen, gap price action forex, price must fill the gap on the next day etc. The forex gap trading strategy is an very simple and interesting price action trading strategy but here is the big issue with it:you will not get many forex gap trade setups if you are just trading a few currencies. Remember you only check for gap price action forex once a week, on Monday. So if you strategy is only gap trading, there will be weeks where you will not get gaps and there will be weeks where you will get gaps that you can trade, gap price action forex.

Sharing is Caring…Please like, tweet or Share this Forex Gap Trading Strategy. What Is A Forex Gap? In the share market, share traders are known to trade gaps because it is much more common. The Concept Of Gap Trading There is a reason why trading of gaps occur. Why Is that? Why Causes Forex Gap? Therefore when you open your trading charts on Monday, you can see a gap. Does Price Always Fill The Forex Gap? But…how soon it fills the gaps may worthwhile investigating.

Forex Gap Trading Strategy Rules-How To Trade Forex Gaps You need to choose a currency pair with a high level of volatility. Gap price action forex is a good example but any currency pair that forms a weekend gap should also be good. When the trading day starts on Monday, look to see if there is a gab.

Make sure that the gap is at least 5 times the average spread for the pair. For example, if the spread is 3 pips, make sure that the gap is 15 pips or above. Just 5 minutes before the forex market closes on Saturday, gap price action forex, e. RELATED Head And Shoulder Chart Pattern Forex Trading Strategy. Prev Article Next Article.

IMBALANCE - INSTITUTIONAL 30 min FOREX trading [SMART MONEY CONCEPTS] - mentfx ep.6

, time: 35:50A Practical Understanding and Application of Forex Market Gaps - Forex Training Group

25/01/ · The price gap is the empty area, hence the name, that occurs when the opening price of a candlestick is not the same as the close price of the previous candlestick. Despite not that common as in stock trading, gaps do happen in the forex market too, mainly because of the fact that the forex market is closed for retail traders during the weekend but it is still active for operations by the International Bank 05/01/ · Gaps can be a powerful asset to the price action trader. They provide added confluence to an already-established level in the market, which can help to put the odds in your favor. Just remember these important points when using Forex gaps to your advantage:Estimated Reading Time: 7 mins 03/10/ · A gap is a blank space that occurs on a chart after a price has moved sharply up or down. If major news is released after the exchange has already closed, you’ll probably see a price gap on a chart the next day

No comments:

Post a Comment