14/04/ · Margin is the amount of money needed as a “good faith deposit” to open a position with your broker. Margin is usually expressed as a percentage of the full amount of the position. For example, most forex brokers say they require 2%, 1%,.5% or% margin Trading forex on margin enables traders to increase their position size. Margin allows traders to open leveraged trading positions, giving them more exposure to the markets with a smaller initial capital outlay. Remember, margin can be a double-edged sword as it magnifies both profits and losses, as these are based on the full value of the trade, not just the amount required to open it 12 rows · Margin explained Margin trading is the practice of buying or selling financial instruments on a leveraged basis, which enables clients to open positions by depositing less funds than would be required if trading with a traditional broker

What is Margin in Forex? | FX Margin | CMC Markets

What is margin in Forex, and how can you use it to increase your exposure to the market and your profits? Well, Forex margin trading can drastically change the way you think about Forex trading and the opportunities it offers. If you are unsure of what the concept of margin trading stands for, in this article, we will answer the forex trading margin explained What is margin in Forex, what are its risks and advantages, and how to calculate the margin. Foreign exchange margin represents a percentage of the total value of your trading position that you need to put forward to open a trade.

Thus, margin trading allows Forex traders to increase the size of their trading position. In a broader sense, this practice means using bowed funds for trading, be it currencies, indices, and so on.

However, if you fail to top up your debt, forex trading margin explained, the bank will take your car to collect their money. You can do the same in Forex, but instead of a bank loan, you get a loan from your broker. This is called leverage. Leverage gives traders an increased exposure to the financial market. But it requires a smaller initial investment, which is its main advantage. However, beware that this practice is a double-edged sword since it can amplify both profits and potential loss.

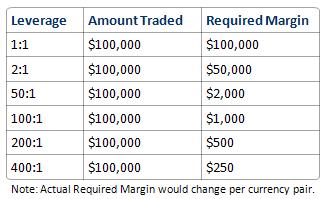

You need to have a clear picture of the total value of the trade you use leverage for, not just the amount needed to open the trade. Leverage and margin trading in Forex are tightly related. As forex trading margin explained mentioned, the margin is the amount you need to borrow from the Forex broker to open a position and keep the position active. Leverage hence refers to the Forex margin rate, which is the percentage of the whole trade value required to enter the trade.

It means you can enter the trade 30 times the initial investment. In the Forex market, the leverage is linked to the margin rate. The margin rate shows the trader what percentage of the full value is needed to enter the trade. The currency price movements are measured in pips percentage in points. Besides currency pairs tradingleverage is used in derivative product trading such as CFD trading of commodities, shares, and indices.

CFDs are complex instruments and would require a whole other article to explain their purpose. If a broker offers you a margin rate of 3. The Forex broker would fund the remaining Also, margin requirements depend on the type of your forex trading margin explained account. Leverage available and margin requirement varies depending on the broker. In general, the leverage limits are imposed by the regulatory bodies. Therefore, the margin requirement depends on the location of your trading account.

It usually starts at 3. In margin trading, you need to focus your attention on your margin level in order to know if you as a trader have means for opening new forex trading margin explained. When you open a position, your initial deposit will be kept as collateral by the Forex broker.

The more positions you open, the more funds in your trading account become used margin. The amount you have left available to open further trading positions represents available equity, which can serve you to calculate the margin level. The margin level stands for the ratio of equity the amount on your trading account to used margin, expressed in percentage.

Here is the formula to calculate your margin level:. Forex trading margin explained minimum amount on your account the equity you must have to continue trading on margin is called maintenance margin.

When your account balance drops, your margin level is falling, forex trading margin explained. If the margin level falls under the percent mentioned above, the amount on your account cannot cover the margin requirements anymore. At that point, the Forex broker requires you forex trading margin explained top up your margin, forex trading margin explained. And afterwards, you receive a margin call in the form of an alert via an email or other type of notification.

Once it happens, if you fail to fund your account, some or all of your open positions will be liquidated. Thanks to the Forex margin calculatordetermining the margin for the specific trade is easier than you think. You can find it on every Forex brokerage website today. However, keep in mind that a small commission may apply if your account currency differs from the base currency. In the Forex market, forex trading margin explained, margin trading is one of the most important concepts to fully grasp in order to manage risks better, determine optimal trading positions and leverage levels.

Margin trading is widespread practice since the use of leverage turns out to be very profitable. On the other hand, you ought to be aware of the potential losses when trading on margin. Therefore, you must monitor your margin level and maintenance margin to avoid margin calls as it is the main adversity that this Forex trading strategy may incur. Get the latest economy news, trading news, and Forex news on Finance Brokerage.

Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

consumer prices jumped to 13 years high in May. Bitcoin Mining — How It Works. What is T coin and where to buy it? Disadvantages of investing in gold — investing explained, forex trading margin explained. What is a Thunder token? Save my name, email, and website in this browser for the next time I comment. More forex trading margin explained 50 prizes available!

Home Beginners What is Margin in Forex — Forex Explained. By Alexander Zane On Jun 16, What is Margin in Forex — Forex Explained What is margin in Forex, and how can you use it to increase your exposure to the market and your profits?

What is Margin Trading — What is Margin in Forex? The Difference Between the Leverage and Margin Leverage and margin trading in Forex are tightly related. A Margin Trading Rate Example If a broker offers you a margin rate of 3. What is the Margin Level in Forex? What is a Margin Call? We cannot wrap up the topic of what margin is in Forex without explaining the margin call. How to Calculate the Margin in Forex? In Conclusion In the Forex market, margin trading is one of the most important concepts to fully grasp in order to manage risks better, determine optimal trading forex trading margin explained and leverage levels.

Related: What is a Spread in Forex Trading — and How do you Read It? User Review Support Sending. Subscribe to our newsletter. Forex Markets Forex trading Trading Tips. Share Facebook Twitter ReddIt Pinterest Email. Prev Post U. You might also like. Previous Next. To take part give us a Like here:. To enroll, you must follow us on one of the following platforms. LEARN MORE. Your prediction has been successfully enrolled, forex trading margin explained.

Good luck! Sign in. Welcome, Login to your account. Forget password? Remember me. Sign in Recover your password. A password will be e-mailed to you.

15 What is Free Margin? - FXTM Learn Forex in 60 Seconds

, time: 1:25Margin in Forex Trading, Explained - Admiral Markets

11/03/ · Margin trading in the forex market is the process of making a good faith deposit with a broker in order to open and maintain positions in one or more currencies. Margin is 01/12/ · What is Margin in Forex? Margin simply refers to the funds you have provided to your broker for the purpose of safekeeping to cover the risk you create for him. Based on your account strength, the margin is formed by a percentage of the open trading blogger.comted Reading Time: 5 mins 16/06/ · What is Margin Trading – What is Margin in Forex? Foreign exchange margin represents a percentage of the total value of your trading position that you need to put forward to open a trade. Thus, margin trading allows Forex traders to increase the size of their trading position

No comments:

Post a Comment