Parkside First National Bank of Namibia LTD C/O Fidel Castro & Independence Ave Box , Windhoek Tel: infonam@blogger.com The Parkside branch also services RMB, Homeloans and WesBank clients. RMB Namibia Tel: RMB Corporate Banking Tel: infonam@blogger.com WesBank C/O Fidel Castro & Independence Ave Box , Windhoek First National Bank of Namibia LTD C/O Fidel Castro & Independence Ave Box , Windhoek Tel: infonam@blogger.com The Parkside branch also services RMB, Homeloans and WesBank clients. RMB Namibia Tel: RMB Corporate Banking Tel: infonam@blogger.com The expense ratio is calculated by taking the operating expenses and then dividing them by earned premium. Calculated as: (Total Operating Expenses - Underwriting Losses Total) / Net Premiums Earned. F.N.B. Corporation (FNB) Expense Ratio data is not available. Quarterly Annual. Figures for fiscal quarter ending Income Statement

Forex Trading South Africa FNB (First National Bank) Guide

Expense Ratio: A measure of profitability used by an insurance company to indicate how well it is performing in its daily operations. The expense ratio is calculated by taking the operating expenses and then dividing them by earned premium. Your free fnb forex expense ratio has expired. Please subscribe to continue using the site. For a limited time, all new subscriptions begin with a one week free trial! If you are already subscribed, please Log In.

Data Table Stock Screener Query Tool Predefined Queries Subscribe Log In. Corporation FNB Last Price: Expense Ratio Quarterly. Corporation FNB Expense Ratio data is not available. Quarterly Annual. Income Statement Financials Revenue. Net Income. Cost of Goods Sold. Gross Profit. Operating Expenses. Operating Income. Pre-Tax Income. Normalized Pre-Tax Income. Income after Taxes. Income from Continuous Operations. Normalized Income after Taxes. Weighted-Average Shares Outstanding Basic.

Fnb forex expense ratio Shares Outstanding Diluted. Earnings per Share EPS Basic. Earnings per Share EPS Diluted. Current Assets. Property, Plant, and Equipment. Long-Term Assets. Total Assets, fnb forex expense ratio. Current Liabilities. Long-Term Debt. Long-Term Liabilities. Total Liabilities. Common Equity.

Tangible Shareholders Equity. Shareholders Equity. Common Shares Outstanding. Cash Flow from Operating Activities. Cash Flow from Investing Activities. Cash Flow from Financial Activities. Beginning Cash. End Cash. Stock-Based Compensation. Common Stock Dividends Paid. Preferred Stock Dividends Paid. Current Ratio. Debt to Capital Ratio. Debt to Equity Ratio. Gross Margin. Operating Margin.

EBIT Margin. EBITDA Margin. Pre-Tax Profit Margin. Profit Margin. Free Cash Flow. Loss Ratio. Expense Ratio. Combined Ratio. Asset Turnover. Inventory Turnover. Receiveable Turnover. Days Sales in Receivables. Return on Equity. Return on Tangible Equity. Return on Assets. Return on Investments. Book Value Per Share.

Free Cash Flow per Share. Operating Cash Flow per Share. Data from Zacks Investment Research, Inc. Tip: Click on any fundamental metric to view a historical chart of that value. Got It! About Contact Terms Privacy, fnb forex expense ratio. Please subscribe to continue using AlphaQuery.

LIVE (uncut) FOMC news Trading - EURUSD \u0026 BTCBUSD trade management during high volatility session

, time: 59:20Foreign Exchange Rates - Rates and Pricing - FNB

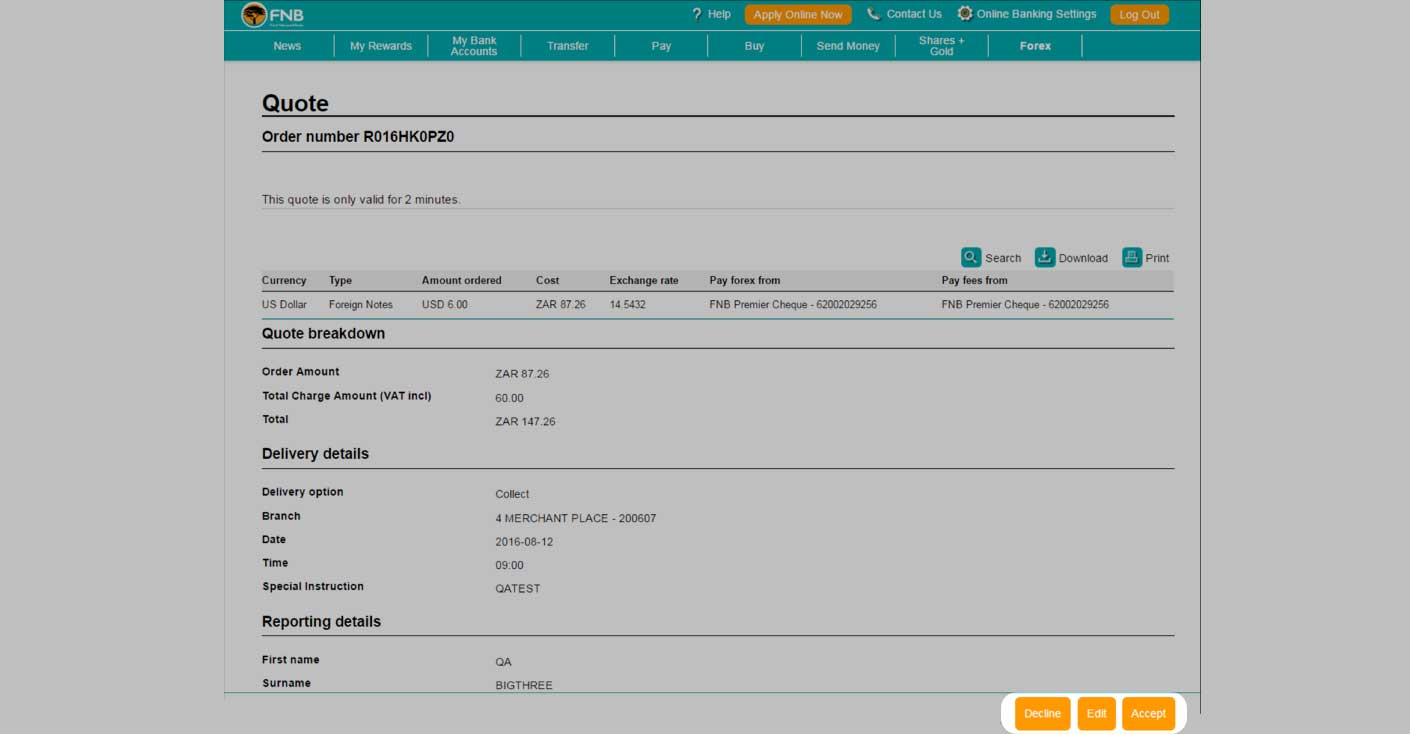

The foreign exchange rates on our site are updated daily (Monday to Friday).Please contact your nearest FNB Branch if you wish to buy or sell foreign currency. Foreign exchange rates. Average rates The expense ratio is calculated by taking the operating expenses and then dividing them by earned premium. Calculated as: (Total Operating Expenses - Underwriting Losses Total) / Net Premiums Earned. F.N.B. Corporation (FNB) Expense Ratio data is not available. Quarterly Annual. Figures for fiscal quarter ending Income Statement Step 1: Login to your Online Banking profile. Step 2: Select the 'Forex' tab, then click 'Global Payments'. Step 3: Pick between a 'Once-off Global Payment' or the 'Recipients' list. Step 4: Provide all the information about the Global Payment. Step 5: Select the reason for

No comments:

Post a Comment