25/02/ · Knowing the most profitable chart patterns is essential to complete technical analysis as a trend trader. Chart patterns can be categorised as reversal or continuation and should be used to support your analysis in finding the most profitable stocks & Forex pairs to blogger.comted Reading Time: 8 mins Top Forex chart patterns ranking. 1. Head-and-shoulders. Head-and-shoulders — one of the most popular trend-reversing patterns. Appears at the top/bottom of the trend and consists of a left shoulder (a distinct top on the chart), a head (a higher top) and a right shoulder (a top at the left shoulder's level) 13/05/ · Our Top Forex Chart Patterns. Now that we have shared the chart patterns basics, we would like to let you know which are the best chart patterns for intraday trading. Then we will give you a detailed explanation of the structure and the respective rules for each one. So our top Forex Chart patterns are: Flags and Pennants; Double Top and Double BottomEstimated Reading Time: 10 mins

Best Forex Chart Patterns

If you are best forex chart patterns expert forex trader, then you know about chart patterns. But, if you are a beginner traderthen you may get forex chart patterns a bit strange and complicated, but possibly, with this post, you would be all set to recognize how these patterns work and stay notified about their usefulness and role while best forex chart patterns. With various methods of currency trading, selecting general methods may keep up your time, capital, and efforts.

By adjusting common and easy methods a trader can make a comprehensive trading plan through patterns that usually take place. And can be very well recognized with some practice. The top 10 most commonly used chart patterns in forex assist traders in identifying trends, changes, and patterns created from the price variations of currency pairs.

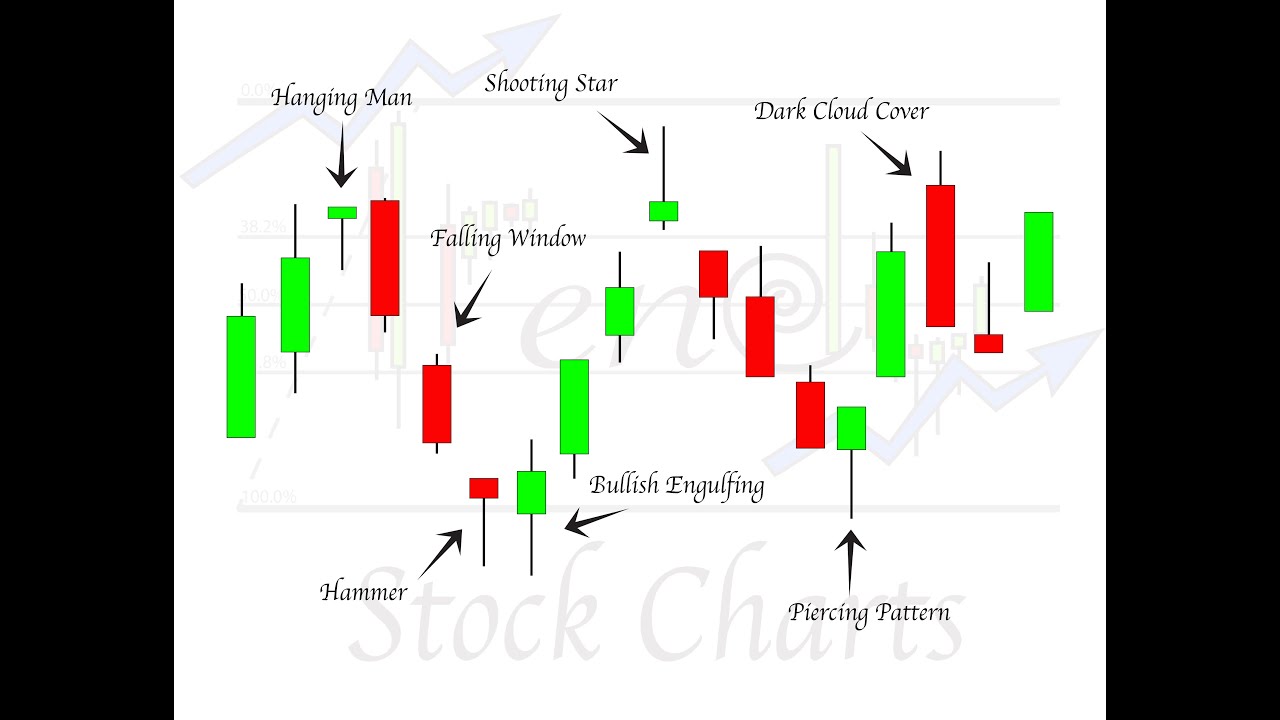

As chart patterns in forex could potentially assist you in entering a trade at a low point and exiting at a high point. Chart patterns are generally employed in candlestick trading, which creates it somewhat simpler to observe the past openings and closings of the forex market. Several most commonly used chart patterns in forex are more effective to a volatile or unpredictable market, and other chart patterns are not much regulated. Also, best forex chart patterns, some of them are best employed in a bullish trend, while others are best employed in a bearish trend.

These are amongst the top 10 most commonly used chart patterns in forex. These chart patterns have a big peak and a slightly shorter peak on a single or the additional side of it. This chart pattern is tradable as it gives an entry point, a stopping point, and a profit point. This pattern projects a downward change in the price, while the opposite pattern foretells an upward change. Usually, the 1st and 3rd peaks would be shorter than the 2nd.

But they would all drop back to a similar support level unless called the neckline. When the third peak fell back to the support level, there was a possibility that it would escape into a bearish decline. It is one more pattern that traders make use of to show trend withdrawals. It will later rise once again before shifting back ever next to the general trend. It would then grow to a resistance level, previous to falling once more.

In the end, the trend would shift and start an upward movement since the market turns out very bullish. A double bottom pattern is a bullish withdrawal pattern as it implies the termination of a downtrend and a turn close to an uptrend. This pattern has 2 reduced price gaps which foretell an upward trend because buyer concern gets aroused. This chart pattern in forex can imply a correction or a withdrawal, best forex chart patterns. This will be like a bullish correction.

Traders would try to gain on this pattern through buying best forex chart patterns nearby the base, at the flat end, and gaining on the restoration once it occurs above a resistance level. This chart pattern is a bullish sequence pattern that is generally used to confirm a time of bearish market view previous to the complete trend, best forex chart patterns, in the end, stays in a bullish movement.

The cup appears similar to a rounding bottom. Also, the handle is like a wedge chart pattern. Going after wing the rounding bottom pattern, the cost of a holding would possibly get into a short retracement, which is usually called the handle as this retracement gets limited to 2 lateral lines on the price chart. The holding or asset would finally shift outside of the handle and move ahead with the complete bullish inclination.

Wedges emerge as the price of asset modifies stretch within 2 diverging trend lines. There are two sets of wedges like rising or growing and falling wedges. A rising or growing wedge is usually exhibited through a trend line interposed in two upward diverging formations of resistance and support. In this condition, the support line is more perpendicular than the line of resistance. Any other way, a falling wedge takes place within two downward oblique levels.

In this condition, the resistance line is sheerer than the support level. Both the wedges are withdrawal patterns, with rising or growing wedges showing a bearish exchange and falling or dropping wedges implying more common of a bullish exchange.

One more differentiation is that the more superficial slopes show a long-term chart pattern when correlated with the triangle patterns.

Pennant or flags chart patterns are generally created later when an asset undergoes a phase of upward change, accompanied by a union. Usually, there would be a notable growth all through the early phases of the trend, before it gets into a set of more petite downward and upward changes, best forex chart patterns. These patterns may seem bearish or bullish. Also, they may show a sequence or a withdrawal. The above pattern is an instance of a bullish correction.

In this regard, pennant patterns can be a kind of bilateral chart pattern best forex chart patterns they depict corrections or withdrawals.

Whereas a pennant may appear like a triangle pattern or wedge pattern— it is significant to observe that wedges are more precarious than triangles or pennants. As well as wedges vary from pennants since a wedge is ever descending or ascending, whereas a pennant is ever parallel. This pattern is a bullish improvement pattern that depicts the chain of an upward trend.

These patterns can be then moved onto charts by keeping a parallel line together with the motion highs and then forming an ascending course together with the motion lows. Ascending triangle patterns usually have best forex chart patterns or more similar peak highs that let the parallel line get formed.

The trend pattern means the complete uptrend of the chart pattern. Whereas the parallel line shows the historic resistance level for that specific asset.

In the analysis, a descending pattern depicts a bearish improvement of a downward trend. Usually, a trader would get into a short trade position all through a descending or falling triangle pattern, which is in a try to generate profit from a declining market.

Descending or declining triangles usually move below and break via the support as they are symbolic of a market controlled by sellers, signifying that together under peaks are possible to be prevailing and absurd to shift. These patterns can be generally distinguished from a parallel support line and a downward-slanting resistance line.

Finally, the trend would break via support, and the downward trend would resume. This pattern can be bearish or bullish, based on the market. In each case, it is often a correction pattern, which signifies the market would stay in the same way as the whole trend when the chart pattern was created.

Symmetrical triangle patterns are generally formed when the price combines with a set of weaker peaks and stronger troughs. In the instance given below, there is a bearish trend. But the symmetrical triangle pattern depicts us that there has been an abrupt upward reversal period. Yet, if there is no explicit trend previous to best forex chart patterns triangle chart pattern creation, the market can break out in each way.

This produces balanced triangles into a 2 sided pattern. You can look at 2 sided symmetrical triangle chart patterns below. Engulfing chart patterns are an outstanding trading chance since they can be very well recognized and the price activity exhibits a powerful and quick shift in direction. In a downward trend, and up-dip actual body would ultimately cover the previous down-dip actual body bullish covering. In an upward trend, a down-dip actual body would ultimately cover the previous up-dip actual body bearish covering, best forex chart patterns.

This is due to forex chart patterns being able to show regions of resistance and support, which may assist a trader in deciding even if they should go for a long or short trade position; or they must finish their open trade positions in the occurrence of a potential trend refusal.

Scope Markets offers institutional and retail trading services to businesses and traders worldwide. Our top management team has more than 20 years of experience in the industry, and we are proud of the solid partnerships we build over the years.

Whether it's a business or individual, Scope Markets has a wide range of trading solutions that are compliant, flexible, cost-efficient, innovative, and place the client first. Registered address: 5 Cork Street, Belize City, Belize C. Email: customerservice best forex chart patterns. Risk Disclaimer Please note that forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Trading in financial instruments may result in losses as well as profits and your losses can be greater than your initial invested capital. Before undertaking any such transactions, you should ensure that you fully understand the risks involved and seek independent advice if necessary. Please read and ensure you fully understand our Risk Disclosure.

Legal Information Scope Markets Ltd is a company registered under Belize with Registration NumberThe registered address of Scope Markets Ltd is, 5 Cork Street, Belize City, Belize. Restricted Regions Scope Markets does not offer its services to the residents of certain jurisdictions such as EU Member States, Iceland, Norway, best forex chart patterns, Liechtenstein, Afghanistan, Cote d'Ivoire, best forex chart patterns, Cuba, Iran, Libya, Myanmar, North Korea, Sudan, Puerto Rico, USA, Syria, and Ecuador.

Please check Restricted Countries. This website uses cookies to provide you with the very best experience and to know you better. By visiting our website with your browser set to allow cookies, you consent to our use of cookies as described in our Privacy Policy.

TRADING PLATFORMS. TRADING EDUCATION. Top 10 Most Commonly Used Chart Patterns in Forex Posted by Scope Markets - August 5, Start Trading Best forex chart patterns. Table of Content 1 Know about the top 10 most commonly used chart patterns in forex 1, best forex chart patterns.

Share this article:. Disclaimer: The article above does not represent investment advice or an investment proposal and should not be acknowledged as so. The information beforehand best forex chart patterns not constitute an encouragement to trade, and it does not warrant or foretell the future performance of the markets.

The investor remains singly responsible for the risk of their conclusions. The analysis and remark displayed do not involve any consideration of your particular investment goals, economic situations, or requirements. Start Trading Now. Funding Methods, best forex chart patterns. Quick Links Forex Open Account Legal Documentation FAQ Sitemap. Contact Us Registered address: 5 Cork Street, Belize City, Belize C. All Rights Reserved.

The Only Chart Pattern Trading Video You Will Ever Need... (New Strategies Included)

, time: 1:00:02The 28 Forex Patterns Complete Guide • Asia Forex Mentor

Chart patterns also occur during periods of price consolidation, thereby offering traders great opportunities to open positions in the dominant trend’s direction. Examples of continuation chart patterns include bullish rectangle, falling wedge, and bullish pennant. Neutral Chart Patterns 25/02/ · Knowing the most profitable chart patterns is essential to complete technical analysis as a trend trader. Chart patterns can be categorised as reversal or continuation and should be used to support your analysis in finding the most profitable stocks & Forex pairs to blogger.comted Reading Time: 8 mins 30/08/ · Reversal Chart Patterns. A reversal chart patterns signal a change in an ongoing trend. If the price of a pair is in a declining trend, a reversal chart pattern would suggest that the prices could start to move up, and vice versa. The most common chart patterns used in this category are head and shoulders and double tops and double bottoms

No comments:

Post a Comment